The Big Short: Biggest Liquidation Yet

Aftermath and thoughts on October of 2025 - a month to remember

Hi,🙋

The Big Short is a new series titled this way for a reason. In it, I’ll be sharing my journey from idea to execution in maximizing gains on the cryptocurrency market. But remember – everything you read here is just my thoughts and my positions. This is not financial advice, and I’m not an advisor, just a regular market participant like you. What I’ll describe here involves excessive risk, which I do not recommend copying ⚠️.

I’ve decided this one to be out for free to read, enjoy!

Let’s start with a quick recap of where we are.

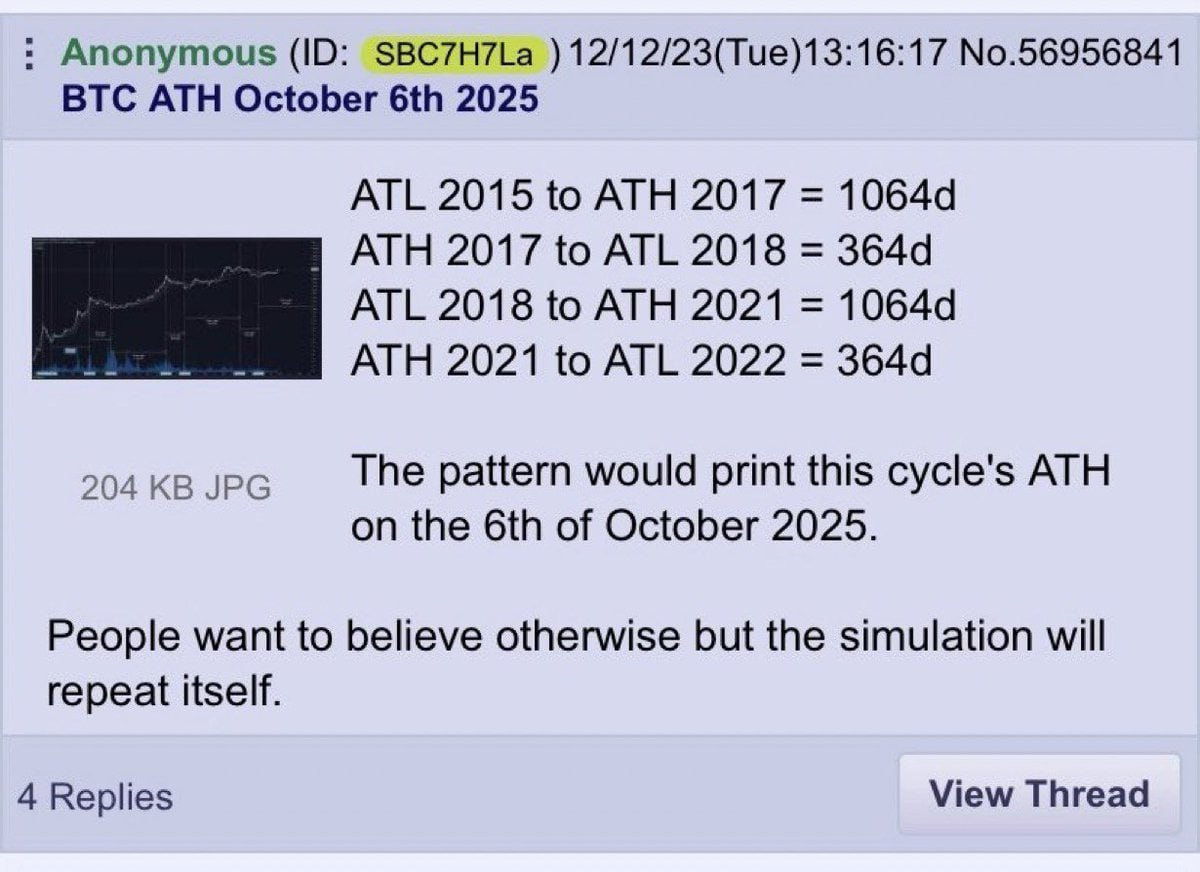

What does the timing look like?

Pretty bad, not gonna lie. It’s exactly the middle of October—the date everybody was waiting for—yet now everyone wants to believe in the continuation of the bull market into 2026. Yeah, right…

So the simulation, fairy dust, flying UFOs, and unicorns are real?

Well, I guess so.

Being real for a second, it’s the truth—we did wait for October 2025, and here we are. Anyone now saying, “Oh yeah, the bull market will continue 100%,” is betting on something that has never happened before.

Speaking of UFOs, on Polymarket there’s now a higher chance that UFOs are confirmed by the end of this year than Bitcoin reaching $200k.

Let that sink in.

Anyway, the conclusion from the timing is that we’re cooked—unless you’re playing on the right side of the market, like I think I am.

Let’s get a little bit technical here.

You know how in 2021 the MACD showed a bearish divergence on the second top?

Well, here it is.

Guess what—the same thing is happening right here, right now.

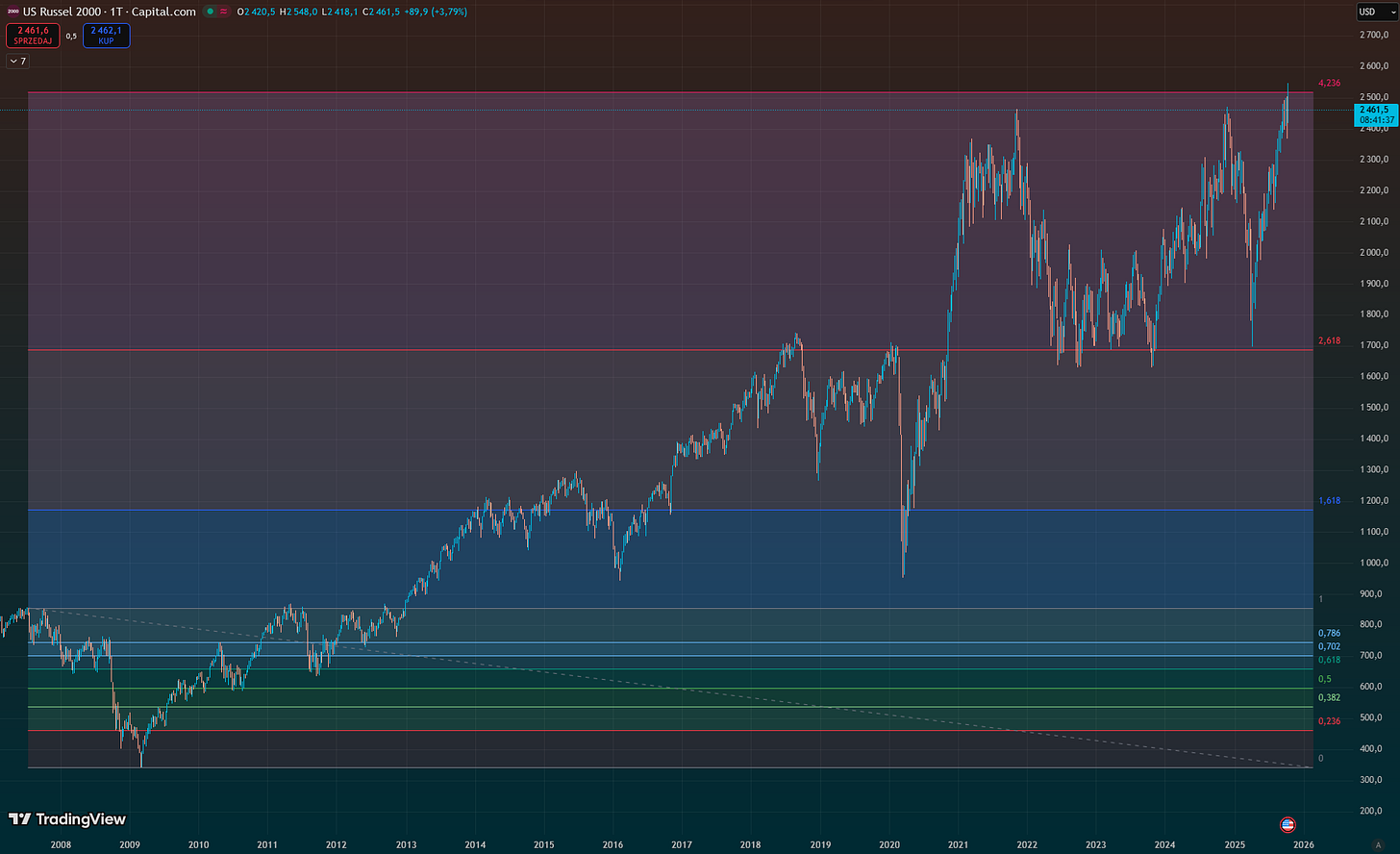

I’ve always written about the big, giant trade and the flow of capital. The consequences of that thesis were simple: RTY growth was crucial for crypto. Anything beyond that for RTY is unknown territory—we can’t measure it. That doesn’t mean it can’t go further; there’s just no method of knowing. Why? Because right here, right now, it’s literally at the 4.236 Fibonacci extension—the LAST one there is.

Anything more for Bitcoin would be an anomaly. But there’s a catch: dominance has started falling.

There has never been a point in history where this MACD cross was fake.

A fun scenario to think about now is Bitcoin doing a 0.702 retrace, altcoins making one last rally (most won’t set new ATHs, just like before and like now), while RTY does a fakeout on the 4.236—and boom, the bear is at your front door.

Of course, it could be different. But at the end of the day, it’s kind of like a betting or probability game. When money is involved, I want to be on the most probable side possible—and that’s not a continuation into 2026, especially not Q4, as some say.

Gold is at its peaks, and that doesn’t help either.

The liquidation

You’ve heard about this—the biggest flash crash, flush, dump, whatever you want to call it, in history. $19 billion wiped out of the market. The takeaway? Some traders lost so much that Binance will supposedly pay some of them back somehow (if that’s not rewarding mistakes, I don’t know what is). Spot buyers are “buying the dip”—they’ll be buying dips for the next year or so. Nobody’s got money left, especially retail, since they all gambled it on leverage.

A new wave of capital is needed to move the price up.

Final Thoughts

Anyway, I like to risk on the probable scenario, so I’m still adding to my Bitcoin short—currently 40% in. However, if I see expansion happening in RTY and Bitcoin at a new ATH, I’ll reduce the position—not fully, but some of it for sure. At some point, the bear market will come, no matter what your favorite altcoin shiller says.

I won’t show you more charts—you all know them. It’s a tricky place we’re in; there’s no clear evidence that one way to act is better than the other. You can find arguments for both sides all day long. The key here is not to fall into a narrative. When emotions and green portfolios weren’t clouding our judgment, we determined that Q4 of 2025 would be the time to get out.

That time is today. And today, everyone wants more—they’re greedy, partially because there was no real altcoin season. Sure, XRP did a 5x, but Bitcoin did more. Most altcoins haven’t even passed their previous ATHs (including Ethereum). Nobody got the 100x Lambo money they hoped for—and the reality is, there is no space in crypto for that anymore.

Crypto isn’t a small niche with unheard-of gains. Let me remind you: we have Bitcoin ETFs (multiple!!!!), Ethereum ETFs (also multiple), and altcoin ETFs supposedly coming this fall. Institutions are already here, making the market. They buy and sell, reducing volatility. The days of 2013 or 2017 won’t come back.

Enjoy the money you’ve already made.

In case you’re wondering, I’m 20% in profit.