The Rate Cut Paradox

You are being told rate cuts are good for the markets, majority is often wrong - here is why!

Everywhere you go you hear that rate cuts are bullish 📈. Are they? Behind this thesis stand serious and seemingly logical arguments, which wrongly push the listener into thinking about rate cuts positively, so let’s start there.

Lower interest rates mean cheaper credit for businesses.

The better a company prospers, the higher its profits and the higher its stock price (in theory — in reality, the market is not 100% efficient). You must understand that the game here is really about business and entrepreneurs; at the end of the day, their financial condition decides whether the price goes up or down.

Imagine you’re the CEO of a manufacturing company 🏭. Your firm already has a loan for a factory and equipment, and you additionally want to expand into another sector, say producing teddy bears. It’s 2021, interest rates are basically near zero, so you’re paying tiny interest on the factory loan, and seeing how cheap money is, you take another loan for Winnie the Pooh machines. 🧸

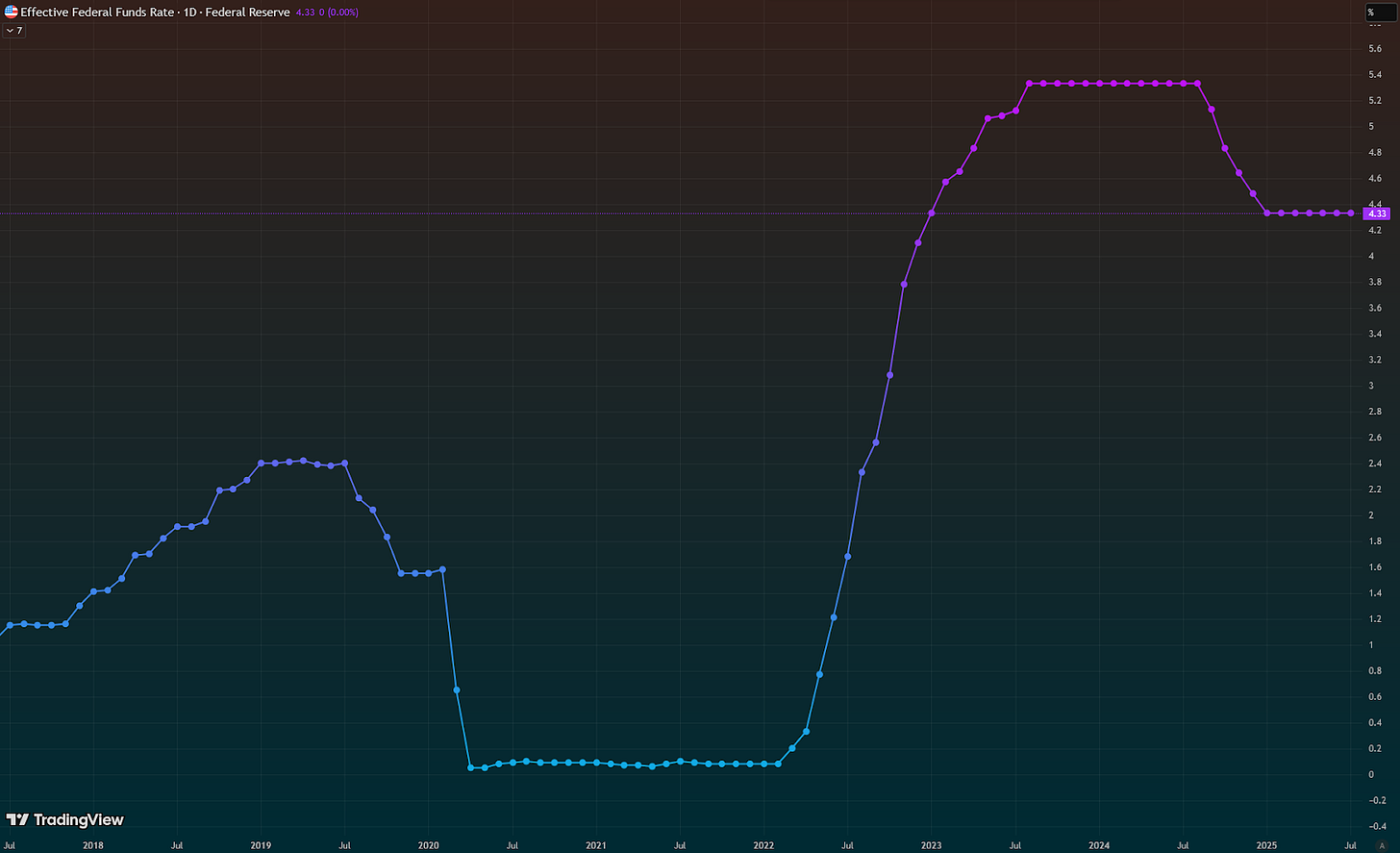

Then inflation hits, Jerome Powell comes out and raises rates — suddenly your cheap credit gets expensive. Instead of 0.5% per year (like in 2021), you’re now paying 6–8% — that’s an extra $50k–100k annually on a $1M loan. Winnie the Pooh costs you 8% per year for nothing, and you haven’t even started selling them. Worse — you can’t find buyers because your marketing team is too busy watching cartoons. The teddy bear venture is a total disaster 🧸💸, and all you’re left with is equipment and rising loan costs.

What now? Now both your factory and teddy bear loans are eating you alive, the high rates drag on for 2 years, and you’ve burned through your savings paying interest. Your business model was built in a cheap-credit environment, but suddenly operating costs multiply. For example, in U.S. manufacturing, debt costs rose 200–300% in 2022–2023 (Bureau of Economic Analysis). Enter Jerome Powell again, lowering rates, and you’re back in business.

Here’s the first red flag 🚨

What if rates don’t get cut in time? You may ask.

Your money runs out, the knight in shining armor never arrives, and you? You go bankrupt. You can’t pay your interest, you’re forced to sell everything, and that’s it — you’re out of business. Larger corporations manage better: they can cut staff, sell parts of assets, or pause new investments. But all of that still reduces company value → stock prices fall 📉.

Now let’s look more from the financial markets perspective. Lower rates decrease the discount rate used to value future earnings — meaning stocks, real estate, and crypto look more valuable. People flee low-yield savings or bonds into higher-return assets, fueling bull runs. If bonds pay zero, why buy them? Even worse, Swiss National Bank introduced negative rates — you had to pay them to hold their debt 🤯. Not attractive, so many prefer assets like Bitcoin, which returned 600% in 5 years at one point.

Rate cuts are also interpreted as the Fed being “proactive,” saving the economy from slowdown. This builds investor confidence, reduces panic risk, and encourages buying — especially at the start of a cutting cycle. But here’s the catch: how many times did the Fed cut too late (and a recession followed right after)?

Since 1954, the Fed cut rates 11 times, and 9 times a recession followed. Only twice in 80 years did cuts not precede a recession — one being the famous 1966 “soft landing.” Today looks similar to 1966… but also very similar to the classic crisis setup.

More problems

The Fed is a huge machine, and much of its data is lagging. Cuts come only after signs of slowdown show up — but those data are already 3 months behind reality. That’s often too late.

2000–2001 (Dot-Com Bubble): Fed cut rates from 6.5% → 1.75%. NASDAQ crashed 50%, recession hit.

2007–2008 (Financial Crisis): Fed cut from 5.25% → 0.25%. S&P 500 fell 57%, recession hit.

2019–2020 (Pre-COVID): Fed cut from 2.5% → 1.75%. Then COVID hit → markets crashed 34%.

Research shows cuts take 6–18 months to impact the economy. By the time they do, recession often has already begun — and markets priced it in already.

Another key: debt.

Low rates encourage more borrowing — exactly like in my teddy bear story. That leads to bubbles, e.g., the housing bubble in 2008, fueled by cuts in 2001 and mortgage debt rising 150%.

Fact

The Fed cuts when it’s already too late.

Where are we now?

We’re actually already after the first cuts.

Markets expect more in September’s FOMC meeting.

At first glance, this looks like a tsunami of liquidity 🌊 for risky assets, including crypto. Cheaper loans could funnel trillions into Bitcoin, Ethereum, and alts. But here lies the paradox: cuts don’t happen in a vacuum — history warns they often signal deeper economic problems, not a lasting bull market.

Liquidity-driven optimism.

We’ve already seen glimpses of the “bullish” side since the cuts began. After the September 2024 rate cut, Bitcoin briefly rose to around $65,000, driven by expectations of easier money and increased leverage in DeFi and margin trading. By Q1 2025, BTC reached historic highs near $109,000, fueled by massive ETF inflows (e.g., Bitcoin ETFs accumulated 51,500 BTC in December 2024 alone, outpacing mining supply by 272%) and broader risk-on sentiment.

This fits the positives we’ve already discussed: lower rates encourage speculation. For example, if the Fed delivers the anticipated 50 bps cut in September 2025 (as Treasury Secretary Bessent suggested), it could further weaken the USD, attract foreign capital into crypto, and spark a short-term pump — potentially pushing BTC above $140,000, according to some trader models.

On X, crypto enthusiasts are buzzing 🎉 — posts like “TRILLIONS WILL FLOW INTO CRYPTO” are gaining traction, highlighting how historically, rate cuts ignited rallies (e.g., Bitcoin’s 1,600% surge after the 2020 cuts). Even macro factors, like earlier rate reductions in Europe and China, are being cited as precursors to a global liquidity wave benefiting high-risk assets like altcoins.

Zoom out, and the paradox becomes clear

These cuts are reactions to mounting economic problems, not proactive growth boosters. The Fed’s easing comes amid warnings of a potential U.S. recession in 2025, with economists like Mark Zandi pointing to a deteriorating labor market — over half of industries are shedding jobs, unemployment fears are reaching Great Recession levels, and planned trade tariffs under President Trump are further damaging sentiment. We’ve all seen the headlines about major companies across industries preparing for layoffs.

J.P. Morgan Research puts the probability of recession at 40% (down from 60%, but still high), while Goldman Sachs estimates 30%, forecasting only 1.25% GDP growth in 2025 — half the 2024 pace and below pre-pandemic averages. And let’s be honest — what these institutions present to the public is worth about as much as a bus driver’s advice on investing in DeFi 🚌💸.

Recent data shows GDP growth returned in Q2 2025, but at a sluggish pace, while consumer confidence keeps eroding despite strong retail sales — a classic paradox signaling underlying fragility.

This mirrors historical patterns:

2001 (dot-com bust) — cuts preceded a recession and market crash,

2007 (financial crisis) — same story,

2019 (pre-COVID) — cuts, then another crash.

In 2025, we’ve already seen volatility

Bitcoin fell from Q1 highs amid macro uncertainty, with billions of dollars in long positions liquidated in July after a hotter-than-expected inflation print temporarily crushed hopes for cuts. Stock markets also fell after the December 2024 cut (S&P 500 down 3%) and, while partially recovering, high-yield spreads have tightened without removing recession fears.

If Powell keeps playing tough, thinking cuts aren’t needed yet, two things happen:

it deepens the later crisis,

it scares investors (since cuts are already priced in, a delay would break the narrative and trigger sell-offs).

What I’m trying to say is

After rate cuts, a recession almost always follows → markets drop → crypto gets hit even harder ⚡. Timing now becomes the key. Everyone already “knows” that the bull cycle should end in fall 2025 because of cyclicality, but markets always surprise the majority. I doubt it will neatly end in October/November, but we are still talking about late 2025 or early 2026.