THAT WAS PROBABLY IT!

Hope this ages like fine milk

Hi,🙋

Welcome to the weekly CryptoFolks Newsletter. However, our launch procedures 🛫 require us to inform you not to consider this article as investment advice, as it represents solely our personal opinion. Always remember to manage your portfolios independently.💁♂️

I’ll start with this picture.

Just as a little keepsake, for the memories 📸. Because today we’re going to go through what the so-called “experts” are talking about right now, and we’ll draw our own conclusions from it.

M2

I don’t know whether this requires more commentary or a psychologist for the people posting it 😅 — and it’s not even an isolated case. Some believers have switched their train to gold.

Alright, now let’s see how it’s going.

Well, shit.

Let’s go back to this M2 — at this point you really need some peripheral vision to believe it 👀. And if that wasn’t enough, it didn’t even work back when the correlation actually existed. Read more about that here:

The M2 Global Money Supply Narrative is Wrong. Here is Why!

Hi,🙋 Welcome to the weekly CryptoFolks Newsletter—a press review 📰of the crypto world and the current macroeconomic situation, where we explore what lies beyond the right side of the chart. However, our launch procedures 🛫 require us to inform you

Maybe one day there will be a full article on this.

Quantitative Easing (famous QE)

The head of the New York Fed suggested in his speech that the Fed might be moving toward money printing and a loose monetary policy. And do you know why? For example:

You know what I’ll say? I don’t believe it — I don’t believe that AI is the reason for the weak labor market numbers 🤖. Sure, some junior-level work can be replaced by a good AI system, but the entire labor market isn’t built only on tech, and definitely not on software developers who are supposedly being replaced.

The FED really might start printing, but not because the soft landing has been achieved and we’re done — it’s because it’s already too late, and the house of cards is starting to collapse. It always starts with the labor market.

Indicators

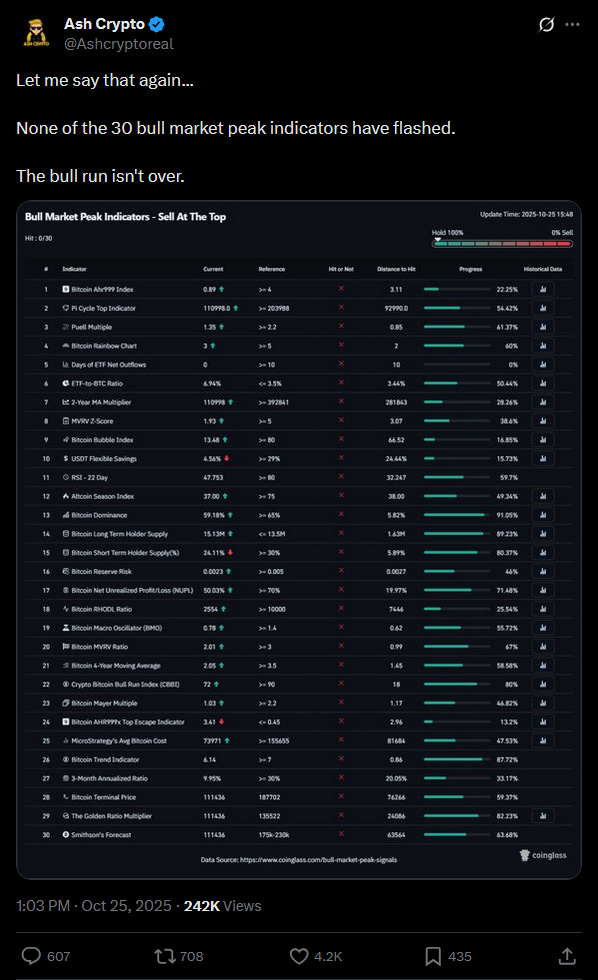

This one is even more obvious than the M2 thing. Too bad nobody showed this when Bitcoin was at $124k 🤦♂️.

Besides, there are things on that list like ETF outflows > 10 days. Did anyone ever verify that? Back then there were no ETFs. Sorry to say it, but market tops usually happen when everyone says they’re buying — not after 10 days of ETF outflows. Something like that has never happened in history — the longest streak of Bitcoin ETF outflows lasted 9 days!!!

I don’t even want to mention that the list also contains CBBI > 90. Well… in history it has NEVER happened that CBBI hit 90 in real time. I talk more about that here:

Don't Be Fooled by CBBI - Is It Any Good?

Hi,🙋 I am Jacob from CryptoFolks, I’m here to talk about the CBBI indicator. Many of you will see it being used by a ton of “crypto experts” but there is a catch I want to show you. I hope you will enjoy this journey! However, our launch procedures 🛫 require us to

I could do this all day — many indicators on that list are completely off, and the levels they claim to “warn” at haven’t worked for like 7 years.

Meanwhile, everyone goes to Coinglass, takes a screenshot, posts it on X and boom — “see, there was no top, no indicator showed it.”

Maybe next time I’d recommend some glasses… or binoculars 🤓.

BlackRock

Now this is the cherry on top 🍒. We’ve got two sides here: one group says BlackRock is selling, the other says “look, smart money (BlackRock) is buying.”

They don’t.

These are not BlackRock’s purchases, this is not their money. They operate those wallets on behalf of ETF clients. How long will it take before everyone understands that?

Stimulus checks

Well… rumors say that Trump will hand out (as a “dividend”) $2000 from what they supposedly earned from tariffs. Whether they earned anything is another question. But those checks would go to the lower-income part of society.

And what do crypto people say? TO THE MOON!!!!! 🚀

“This is it, altcoin season, Bitcoin to $200k!”

You know what I’ll say?

Maybe a lot of low-income people really will buy Bitcoin, and maybe the price even shoots to $150k (which I doubt).

But then what happens?

They get steamrolled by the market — they’ll be the last buyers of this bull run, if it happens.

The retail crowd from the previous cycle moved on to trading futures, adding fuel to the fire — and they’ll get steamrolled too.

And by “steamrolled” I mean something like this:

The market is not a place where every average Joe makes money (even though in 2021 that actually happened).

The market is where the smarter or the more crooked players win (I’m looking at you, Binance 😏).

In 2021, after the announcement and distribution of checks, crypto really did take off — and you could even argue it was the moment that started the parabola.

But that has already happened, and it won’t return.

Usually the second time around, emotions take over. You and I might think “WOW finally everything will rise!”, but in reality, everyone will start selling because they know this is the moment (buy the rumor, sell the news).

Time

Say whatever you want, but definitely not what the entire Twitter keeps repeating like a mantra — that there’s still time for growth, because supposedly M2 exploded so Bitcoin will shoot to $200k tomorrow. You’ve gotta face the truth and admit that the bull market is over, and there was no altseason, and even if by some miracle it were to happen, it definitely wouldn’t be the 2021 version, when even a monkey… or Jim Cramer ;) could make money on crypto. Take a look at the screenshot:

It’s a clear example for all the doubters who stopped believing in cycles. Once again, they proved to be accurate. One full Bitcoin cycle — roughly 3 years of growth and, without rounding, 365 days of decline — lasts around 1430 days, as you can see in the screenshot. Let’s go back to it.

From the end of the 2017 bull market to the end of the next one in 2021, 1431 days passed — almost 100% accuracy. What happened next? The start of the current cycle — a year of decline and another 3 years of growth. Alright, time for some quick math 🧮.

1430 cycle days – 1095 growth days (3×365) = 335 days reserved for the decline (the difference comes from rounding during the bull phase).

This means the official start of the bear market falls 1095 days after the bottom. Now let’s take a look at the chart and see where we stand.

The two orange dashed lines represent exactly 1095 days from the BTC bottom on November 10th, 2022 — the time window for the bull run, the period during which Bitcoin had the chance to hit $200k according to the M2 believers, the time that has now officially ended. Going further — and wanting to be perfectly precise — we could even add the missing 11 days taken from the bear phase. In that case, the bull run ends in two days, this Friday (21.11). See the chart below:

Well… here’s the conclusion: if Bitcoin is supposed to follow M2 and reach $200k, it only has this tiny two-day window left on the chart — just a bit over 48 hours from the moment I’m writing this. Will that happen? Of course it will, there’s no other option… but only if:

— Trump comes out tomorrow and says: “You know what? I’m buying 1 million Bitcoins for the U.S. reserves LOL, let’s see what happens”,

or

— every single person on Earth suddenly wakes up (the blind too 😅) and understands what BTC really is, creating unprecedented demand and a “supercycle”.

Otherwise, we’d need the fattest black swan in history for Bitcoin to keep rising. Time is up — welcome to the bear market. 🐻

Emotions

Recently, I was explaining to a friend how Bitcoin’s cyclicality works. When I finished talking about the halving, 3 years of growth, and 1 year of decline, I showed her a similar screenshot (the one with Bitcoin cycles). She replied: “It can’t be that simple — if it were, everyone who knows even a bit about this would’ve taken profits already.”

Exactly — it can’t be that simple. Why? Because emotions kick in 😅 — the greatest enemy of all investors. Even if you know Bitcoin perfectly, know how it behaves, know how much it typically drops during a bear market… you can still fall for FOMO and hold your position waiting for “just the last 10%” of gains. Then it becomes another 10%, and another… and so on forever.

The key is sticking to your strategy and avoiding the unnecessary noise from clowns who will desperately try to convince others not to take profits and to wait “just a little longer”, only because after 1095 days of growth their own portfolio is still red 🤡.

You can read more about emotions in investing in this case-study-based article:

How Your Emotions Take Control - Case Study

Hi,🙋 Welcome to the weekly CryptoFolks Newsletter. However, our launch procedures 🛫 require us to inform you not to consider this article as investment advice, as it represents solely our personal opinion. Always remember to manage your portfolios